In light of recent increases in the Bank of England's Base Rate during May and June, a comprehensive analysis conducted by Sunny Avenue reveals fascinating insights into the dynamics of the housing market across the UK. By examining data collected from 5,070 properties listed on various platforms with a price tag under £500,000, the findings shed light on a noteworthy shift in market trends, providing a promising moment for prospective buyers nationwide.

Among the properties analysed, a significant number have experienced price reductions. Out of the 5,070 listings, a total of 1,954 homes, accounting for approximately 38% of the total properties, have undergone price adjustments. Interestingly, 1,326 of these reductions occurred specifically during the months of May and June 2023, following the Bank of England's interest rate changes. This indicates a significant response by sellers to the shifting economic landscape and presents an opportune moment for potential buyers looking for more favourable pricing.

Furthermore, the analysis also highlights the emergence of new properties in the market. Out of the 5,070 listings, a substantial 1,326 are newly added properties that entered the market in May or June 2023. This surge in new listings further underscores the adaptability of sellers in response to changing market conditions. When combined with the reduced properties, a considerable 67% of all listings have either adjusted their prices or newly entered the market during May and June, signifying an active response by sellers across the country.

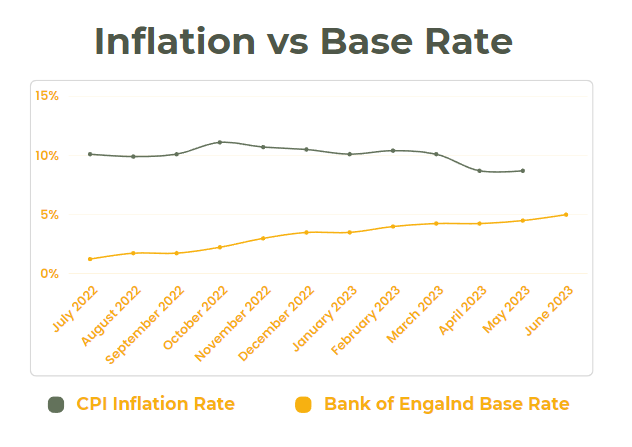

Base rate vs Inflation Changes:

It is important to note that the data provided by Sunny Avenue focused solely on existing housing stock and excludes new builds. This deliberate restriction ensures a comprehensive understanding of the market's response to interest rate fluctuations, allowing for a more accurate assessment of the current situation.

This insightful data signifies a transformation in the housing market across the UK, with sellers increasingly open to negotiation and willing to adjust their asking prices. For prospective buyers, this presents an excellent opportunity to explore affordable properties in various regions, whether they are individuals looking to move homes, first-time buyers, or investors seeking promising investment opportunities.

Earlier this month, Sunny Avenue conducted a survey which revealed low confidence among respondents regarding a return to a 1% base rate, with only 3% believing such a return would occur within the next five years. These sentiments align with the concerns expressed by homeowners across the nation, highlighting the need for careful evaluation of options and seeking professional advice to make informed decisions that align with individual financial goals and circumstances.

Stuart Crispe, the founder of Sunny Avenue, emphasised the importance of evaluating options and seeking professional advice in response to the data, stating, "The data shows a strong indicator of concern due to interest rates among people across the UK. It's crucial for homeowners to carefully evaluate their options and seek professional advice to make informed decisions that align with their financial goals and circumstances."

The data came from a variety of locations across England with the largest discounts coming in the Medway towns with 82% reducing prices in May and June. Unsurprisingly, Newham in London had the fewest with 57% reducing prices. The common expectation is the London housing market could be the one to buck the trend as people return to the City following their Covid premature departures.

Newham is an area experiencing the beginnings of a redevelopment project starting with the new Silvertown tunnel, rivaling Blackwall's. It is due to connect North Greenwich to Silvertown. This could possibly be another reason why there is strong restraint to reduce prices.

The remaining data was collected from Liverpool, Scarborough and Norwich.

In conclusion, the data collected from 5,070 properties under £500,000 across the UK provides compelling evidence of the market's response to interest rate fluctuations. With a significant number of properties experiencing price reductions and the emergence of new listings, prospective buyers have a unique opportunity to explore affordable properties throughout the country. However, it is essential for individuals to carefully assess their options and seek professional advice to navigate the evolving market conditions successfully.

If you're unsure how to get started seeking advice, complete the Sunny Fact Find. The questions you answer help us to find the best-suited adviser for your needs. The adviser contacts you for a no-obligation conversation on how they can help. You decide how to proceed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Leyland, Lancashire

Leyland, Lancashire No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£51,000+

£51,000+  Sheffield, South Yorkshire

Sheffield, South Yorkshire No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.