You can get equity release as tenants in common, but both owners must agree to the equity release as they could selling their ownership as part of the agreement.

Owning a property with others can sometimes be confusing. If you have chosen to be tenants in common, you may not be aware of the impact that can have on being approved for equity release.

In this insight, we will help you understand this better. We will talk about what "tenants in common" means, how it works, and how it affects using equity release lifetime mortgages and home reversion plans. By learning about equity release and tenants in common, you can make better choices about your property.

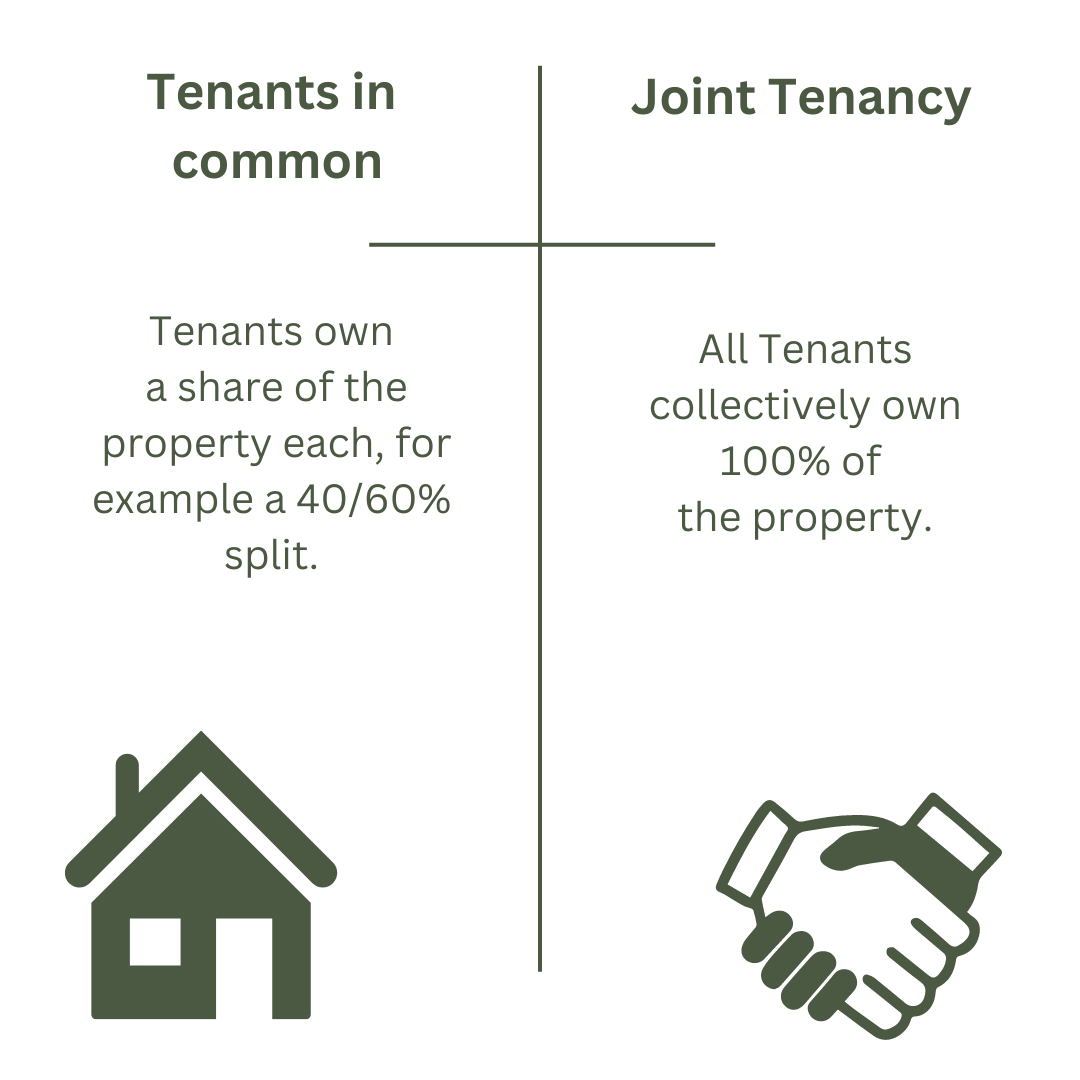

Tenants in common is a way for people to own a property together. Each person owns a share of the property. The shares can be equal or different. For example, one person can own 60% and the other person can own 40%. If one person passes away, their share goes to their chosen person, like a family member. This is different from another way of owning property called "joint tenants," where the owners have equal shares and the property goes to the other owner if one passes away.

Equity release is a way for people to get money from their property. Usually, older people use equity release to get some cash without having to sell their home. There are two main types of equity release: lifetime mortgages and home reversion plans. A lifetime mortgage is a loan that you pay back when you sell your home or pass away. A home reversion plan means you sell part of your home to an equity release company and can still live in it until you pass away or move out.

When you own a property as tenants in common, it can affect how you get money from equity release. If one person wants to use equity release, both owners need to agree. This is because both owners have a share in the property. For example, if you own 60% and your friend owns 40%, you both need to agree to use equity release. If you both agree, you can use equity release and get money from your property.

If you aren't sure whether you are tenants in common or joint tenants, you can check your title deeds or mortgage contract. It's important to know what agreement you have as it can impact your rights to the property ownership.

For equity release as tenants in common, you are still able to raise up to 60% of the property value on a home reversion scheme or a lifetime mortgage. However, the amount you can raise will depend on your circumstances. Taking into account different factors, such as:

There are a few property types where different equity release rules apply. Read more information on the following property types to see how equity release is impacted:

If you are using a home reversion plan, you need to decide whose shares are being sold as part of the agreement. For example, if you own the property on a 40/60% split. The 40% owner can decide to sell all of their shares, whilst the 60% owner retains theirs. However, the condition of equity release for tenants in common is that the 60% owner agrees to this.

Equity release can have some benefits for tenants in common. It can help you get money from your property without having to sell it. This can be helpful if you need money for things like home repairs, paying off debts, or helping your family. Also, using equity release as tenants in common can help protect your share of the property. This means your share can still go to your chosen person when you pass away.

Before you decide to use equity release as tenants in common, there are some things to think about. First, make sure both owners agree to use equity release. It is important to talk to each other and make a plan. Second, think about the costs of equity release. There can be fees and interest rates to pay. Make sure you understand these costs before making a decision. Finally, talk to a professional for advice. They can help you make the best choice for you and your property.

If you're unsure where to start with equity release advice as tenants in common complete the Sunny Fact Find for Mortgage advice. The answers you provide help us to find the best-suited adviser for your needs. Your adviser then contacts you to discuss your circumstances. You decide how to proceed.

No. Equity release can be in joint or sole names, as long as both owners agree to the terms of equity release.

Anymore owners than 2 will need to be removed from the title deeds.

Yes. Tenants in common can get equity release but both co-owners must agree to the equity release terms.

Upon death of one owner, the lender may restrict further borrowing as the new owner may not fit the terms required.

Both co-owners will need to be aged 55 and over to qualify for equity release as tenants in common.

If one owner is not over 55, ownership can be transferred to the other to get around age restrictions.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Leyland, Lancashire

Leyland, Lancashire No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£51,000+

£51,000+  Sheffield, South Yorkshire

Sheffield, South Yorkshire No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.