Moving into a new house is a big deal, and it's hard to remember the exact date when it happened.

Don't worry, in this insight, we're going to help you figure out when you moved into your house. We understand that things can get a little mixed up and messy, especially when there's so much going on.

So, let's get to it and find out when you became a resident of your home. Get ready to discover the answer to the question, "When did I move into my house?"

Not when, but where. Where can I find the details of my moving in date. Fortunately, there are records for pretty much everything these days, including when you moved into your house. The bad news is that it may come at a slight cost.

However, to answer the question of when did I move into my house, you will need to find the most-suitable holder of your records.

Determining where to look depends on how accurately you need the information.

If you need to know, to the specific day, you may need to do some thorough digging with a bit of patience involved.

If you are looking just for the month, you might get lucky with a quick google search.

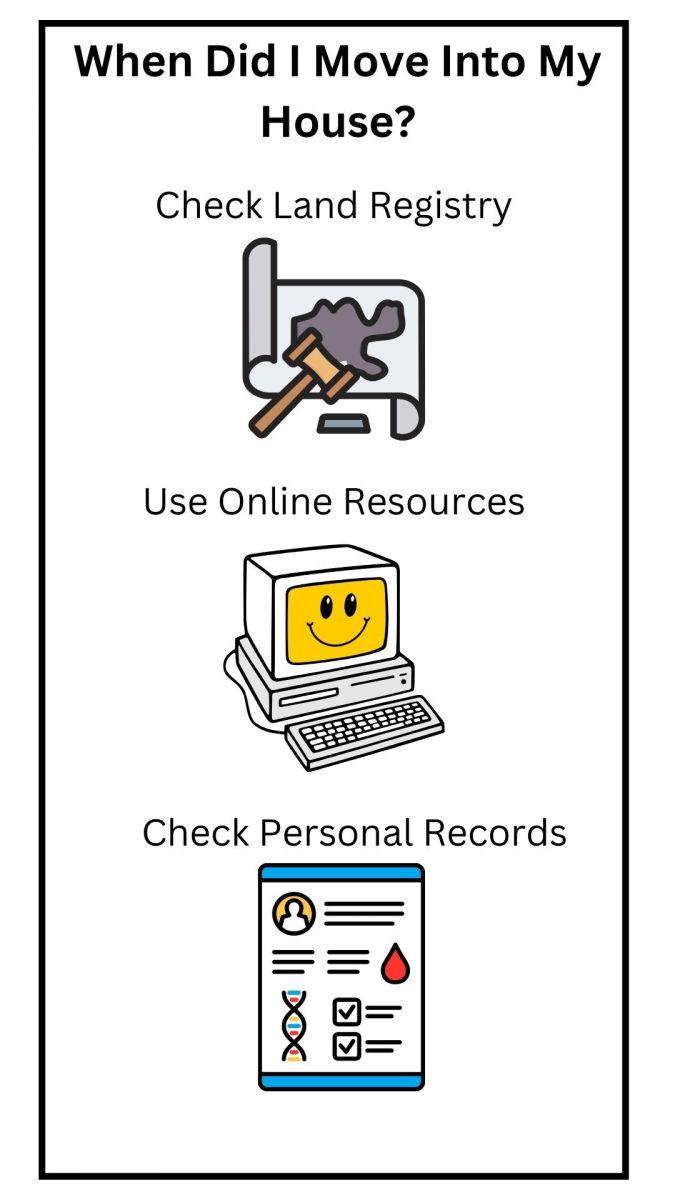

Here are your options:

Try it FREE for 30 days, then £14.99 a month - cancel online anytime

The land registry is arguably the most obvious place to check. It will also be the most accurate. If you require the exact moving-in date, this is a good starting point.

Sounds familiar?

Remember when you were moving into your house, you paid your solicitor to do some legal work.

One of those jobs was to register your details with the land registry. That is what they do. They maintain an official register that includes details about property transactions, your details, and the date of purchase. Perfect.

To access this information, you can perform a search with the Land Registry. Here's how you can do it:

If you are unable to find the information online or need further assistance, you can contact the Land Registry directly.

They will be able to guide you on how to access the specific information you require.

Keep in mind that accessing information from the Land Registry may involve a fee, and certain details may be restricted or require additional verification.

If you only require the month and year that you moved into your house, online resources may be the quickest solution. Websites like Rightmove can provide historical sale information for properties in the UK.

Rightmove is a property listing website that displays properties for sale or rent. While their primary focus is on current listings, they may also have some historical data available.

Here's how you can check for old sale information on Rightmove:

The availability and extent of historical information on Rightmove can vary. While some listings may provide detailed historical data, others may only display the most recent sale information.

Certain properties may not have any historical information available if they have not been sold recently or if the sales data is not publicly accessible.

If you are unable to find the information on Rightmove, you can also consider checking other property listing websites or consulting local estate agents.

To find out the answer to the question, when did I buy my house, you can check your credit report. If you purchased with a mortgage, the date you purchased your home will be the date you opened your mortgage acccount. This information is provided on UK credit reports.

Try it FREE for 30 days, then £14.99 a month - cancel online anytime

You should have found your details by now, but if you're still hunting, here are your other options to find your moving in date:

Look for any documents or paperwork related to your house purchase or rental agreement.

This includes contracts, tenancy agreements, or mortgage paperwork. These documents often include the start date of your tenancy or ownership.

Check your bank statements or any other payment records related to your house. Look for the first payment you made towards rent or mortgage.

This can give you an idea of when you started living in the house.

If you are renting the property, get in touch with your landlord or the estate agent who facilitated the rental.

They should have a record of your move-in date on file.

Contact your utility providers such as gas, electricity, or water companies.

They often have records of when services were activated at your property. The start date of your utility services can indicate when you moved in.

Reach out to the local council in the area where your house is located.

They may have records of when you registered for council tax at your current address. The council tax registration date can serve as an indicator of your move-in date.

Look through your emails, letters, or other correspondence related to your house. You might find notifications or confirmations that mention the move-in date.

It is a good idea to keep these records safe. There are a number of occasions that you are going to need to know your address history. Some of the most common occasions include the following:

The move-in date of your house may be relevant for credit checks and security assessments (such as when you join a new company). When applying for loans, mortgages, or other forms of credit, lenders may ask about the duration of your residence at your current address.

They will run checks to confirm there are no adverse credit records at the address and the address and dates you include match your credit report.

Knowing when you moved into your house is essential for home insurance. Insurance providers use the move-in date to determine cover start dates and calculate factors like no claims discount. Accurate information avoids problems during claims or policy renewal, ensuring proper protection for your property.

Understanding your move-in date provides insight into the history of your property. It can be valuable when assessing property value appreciation over time when you come to sell. You can use this information to consider what improvements or extensions you have made. Provide this information to potential buyers.

By using the information provided in this insight, you should now have the answer to the question "When did I move into my house". Remember to keep a safe record. It helps with credit checks, home insurance, and understanding property history and value.

By keeping records of this information, you'll be prepared for any future needs and ensure a smooth process whenever you need to know when you officially become a resident of your home.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Cheltenham, Gloucestershire

Cheltenham, Gloucestershire No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£51,000+

£51,000+  Sheffield, South Yorkshire

Sheffield, South Yorkshire No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Initial fee free consultation

Initial fee free consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.