Living in the United Kingdom offers a unique blend of history, culture, and opportunities. Whether you are considering a move to the UK or are already a resident, it is crucial to have a clear understanding of the average cost of living in the UK.

In this insight, we will delve into the nitty-gritty details of the average cost of living in the United Kingdom and provide you with valuable insights to help you plan your finances accordingly.

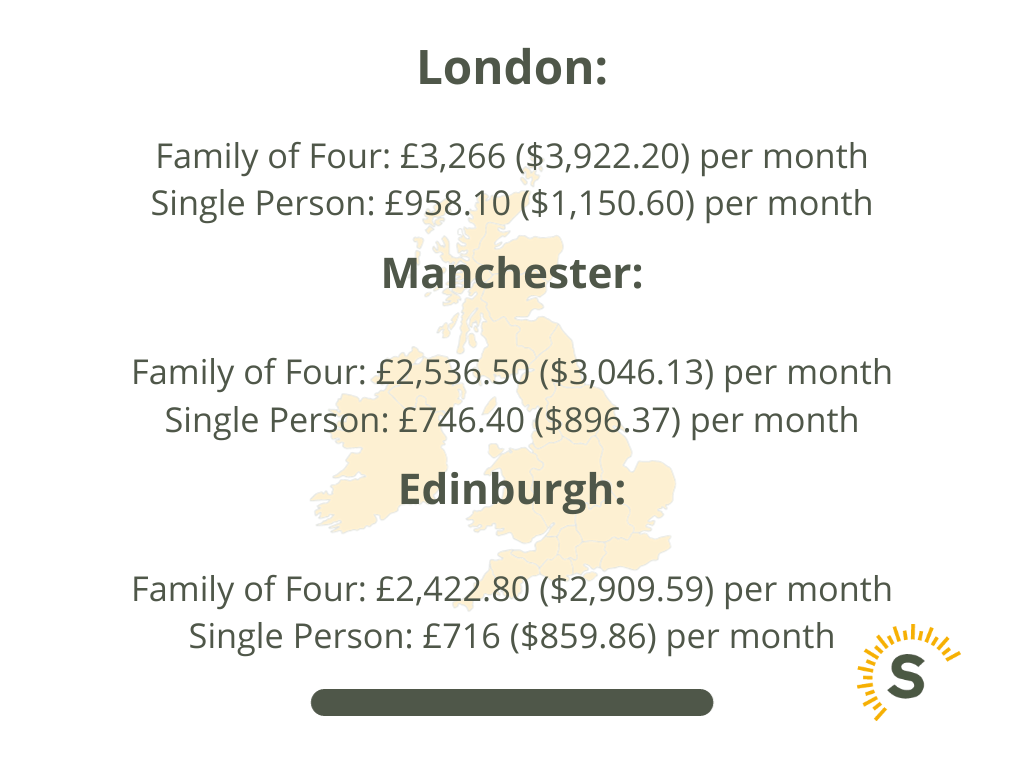

The cost of living in the UK varies significantly by location. In London, living costs are highest, with a family of four needing around £3,266 per month. Manchester offers more affordable urban living, while Edinburgh falls in between. Costs fluctuate based on location and lifestyle.

The cost of living in the United Kingdom varies greatly by region and urbanisation. In London, the most expensive city, a family of four might spend around £3,266 ($3,922.20) monthly, with single individuals needing about £958.10 ($1,150.60). In Manchester, a more affordable city, costs drop to approximately £2,536.50 ($3,046.13) for a family of four and £746.40 ($896.37) for a single person. Edinburgh, with its rich culture, falls in between, averaging about £2,422.80 ($2,909.59) for a family of four and £716 ($859.86) for a single person. These figures fluctuate based on location, lifestyle, and housing choices.

Just like in any country, the cost of living in the United Kingdom can vary significantly from region to region and city to city. Factors such as the local economy, job opportunities, and lifestyle amenities play a crucial role in determining living costs. Typically, major cities and urban areas tend to be more expensive, while rural areas and small towns offer a more affordable cost of living. However, there can be exceptions, and it is essential to consider these factors when planning your budget.

Unsurprisingly, London is the most well-known and expensive city in the United Kingdom. As one of the largest cities in Europe, it boasts a vibrant cultural scene, numerous job opportunities, and a bustling economy. However, these advantages come at a price. The cost of living in London, excluding rent, is significantly higher compared to other cities in the UK. For a family of four, the average monthly cost of living in London is around £3,266 ($3,922.20), while a single person can expect to spend approximately £958.10 ($1,150.60) per month.

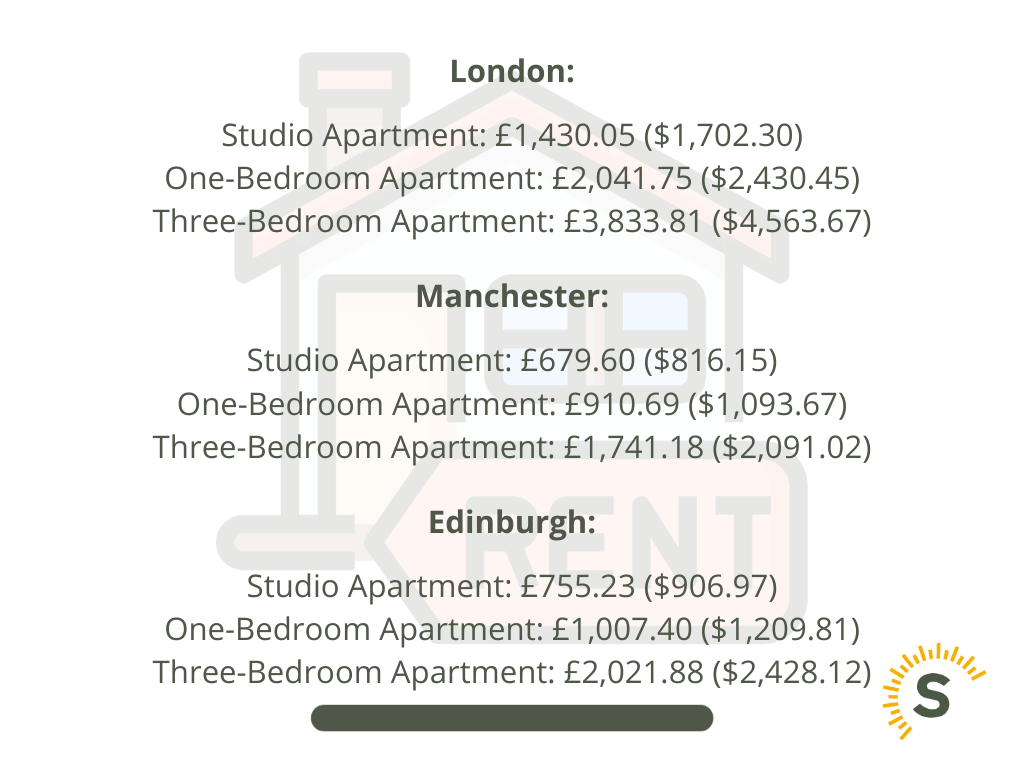

Accommodation costs in London are particularly high. The average price for a three-bedroom apartment in the city centre is approximately £3,833.81 ($4,563.67) per month, while the same apartment outside the centre can cost around £2,531.35 ($3,013.26) per month. These figures highlight the premium associated with living in the heart of the city.

In recent years, Manchester has emerged as a popular alternative to London. With its vibrant cultural scene, thriving economy, and lower living costs, it has attracted both residents and businesses. The average monthly cost of living in Manchester, excluding rent, is around £2,536.50 ($3,046.13) for a family of four and £746.40 ($896.37) for a single person.

Accommodation costs in Manchester are comparatively lower than in London. A three-bedroom apartment in the city centre averages around £1,741.18 ($2,091.02) per month, while the same apartment outside the centre can cost approximately £1,052.50 ($1,263.97) per month. These figures make Manchester an attractive option for those looking for more affordable urban living.

Edinburgh, the capital of Scotland, is renowned for its stunning architecture, rich history, and vibrant arts scene. While it offers an exceptional quality of life, it comes with a higher price tag. The average monthly cost of living in Edinburgh, excluding rent, is approximately £2,422.80 ($2,909.59) for a family of four and £716 ($859.86) for a single person.

Accommodation costs in Edinburgh reflect its popularity and limited availability. A three-bedroom apartment in the city centre can cost around £2,021.88 ($2,428.12) per month, while the same apartment outside the centre averages £1,188.33 ($1,427.09) per month. These figures highlight the premium associated with living in this charming city.

Housing is one of the most significant expenses for individuals and families in the United Kingdom. The cost of renting or buying a property varies depending on location, size, and amenities. It is essential to consider your budget and priorities when choosing accommodation.

Renting a home is a popular choice for many residents in the United Kingdom. The rental market offers a range of options, from studio apartments to larger family homes. The cost of rent varies depending on location, with major cities and urban areas generally commanding higher prices.

To give you an idea of the rental market, here are the average monthly rental costs for various types of properties in different cities:

City |

Studio Apartment |

One-Bedroom Apartment |

Three-Bedroom Apartment |

|---|---|---|---|

| London | £1,430.05 ($1,702.30) | £2,041.75 ($2,430.45) | £3,833.81 ($4,563.67) |

| Manchester | £679.60 ($816.15) | £910.69 ($1,093.67) | £1,741.18 ($2,091.02) |

| Edinburgh | £755.23 ($906.97) | £1,007.40 ($1,209.81) | £2,021.88 ($2,428.12) |

It is important to note that these figures are averages and can vary depending on factors such as location, property condition, and local demand.

In addition to rent, utility bills are an essential part of the cost of living in the United Kingdom. These include electricity, gas, water, and internet services. The amount you pay for utilities can vary based on factors such as the size of your property, energy efficiency, and personal consumption.

On average, monthly utility costs for a small apartment in the UK can range from £100 to £150 ($120 to $180). It is advisable to budget for these expenses to ensure that you are financially prepared.

Getting around the United Kingdom efficiently and cost-effectively is crucial for many residents. Transportation costs can vary depending on factors such as location, mode of transport, and frequency of travel.

Public transportation is a popular and convenient option for commuters in the United Kingdom. Cities and urban areas offer extensive bus and train networks, ensuring easy access to work, schools, and recreational activities.

The cost of public transportation varies depending on the mode of transport and location. For example, in London, the average monthly cost for a travel card that allows unlimited travel within specific zones is around £135 ($162). In other cities, such as Manchester and Edinburgh, monthly bus or train passes can range from £50 to £100 ($60 to $120), depending on the distance and frequency of travel.

Car ownership in the United Kingdom comes with additional expenses such as fuel, insurance, parking, and maintenance. These costs can significantly impact your monthly budget. It is essential to consider whether owning a car is necessary and financially viable for your lifestyle.

On average, the cost of petrol (gasoline) in the UK is around £1.30 ($1.56) per litre. Insurance costs vary based on factors such as your age, driving experience, and the type of vehicle you own. Monthly parking fees in cities can range from £100 to £200 ($120 to $240), depending on the location.

Grocery and food expenses are essential components of the average cost of living in the United Kingdom. The amount you spend on groceries can vary depending on factors such as your dietary preferences, location, and lifestyle.

The cost of groceries in the United Kingdom is influenced by various factors, including location and store choice. Larger cities tend to have a wider range of grocery options, including both budget-friendly and high-end stores. It is advisable to compare prices and shop strategically to make the most of your budget.

On average, a single person can expect to spend around £150 to £200 ($180 to $240) per month on groceries. For a family of four, the monthly grocery bill can range from £400 to £600 ($480 to $720), depending on dietary preferences and lifestyle.

Eating out is a popular social activity in the United Kingdom, offering a wide variety of cuisines and dining experiences. However, dining out regularly can significantly impact your budget. It is essential to strike a balance between eating out and cooking at home to manage your expenses effectively.

The cost of a meal at a mid-range restaurant in the UK can range from £12 to £25 ($14 to $30) per person. Fast food options and takeaways are generally more affordable, with an average meal costing around £5 to £8 ($6 to $10) per person.

The NHS offers comprehensive healthcare services, including doctor consultations, hospital care, and emergency services. As a UK resident, you are entitled to free healthcare through the NHS. However, waiting times for non-urgent treatments can vary, and some services may require referral from a general practitioner (GP).

It is important to register with a local GP to ensure access to primary healthcare services. This is usually a straightforward process and can be done through the NHS website or by visiting a local GP practice.

Education and childcare costs are significant considerations for families in the United Kingdom. Whether you have children or are planning to start a family, understanding the expenses associated with education and childcare is crucial for financial planning.

In the United Kingdom, school education is compulsory for children aged between 5 and 16. The education system is divided into primary schools (ages 5-11) and secondary schools (ages 11-16). Education in state-funded schools is free, while private schools charge tuition fees.

Private school fees can vary significantly depending on the school's reputation, location, and facilities. On average, annual private school fees in the UK can range from £10,000 to £20,000 ($12,000 to $24,000) per year. It is important to research and consider your options when choosing an educational path for your children.

On average, childcare costs in the UK can range from £200 to £300 ($240 to $360) per week for full-time daycare services. Part-time or after-school care options are generally more affordable, with costs ranging from £50 to £100 ($60 to $120) per week.

Living in the United Kingdom offers a wide range of entertainment and recreational opportunities. However, it is essential to budget for these activities to ensure a balanced lifestyle and manage your expenses effectively.

The United Kingdom is renowned for its rich cultural scene, offering a variety of museums, art galleries, theatres, and music venues. Many cultural attractions offer free or discounted admission, allowing residents to enjoy the vibrant arts scene without breaking the bank.

Additionally, recreational activities such as sports clubs, gyms, and outdoor adventures are popular amongst residents. Membership fees and equipment costs can vary depending on the specific activity and location.

Socialising and dining out are integral parts of the British lifestyle. From cozy pubs to trendy restaurants, there is a wide variety of options to suit every taste and budget. It is important to strike a balance between dining out and cooking at home to manage your entertainment expenses effectively.

The cost of socializing and dining out can vary depending on factors such as location, type of establishment, and personal preferences. On average, a night out in the UK can cost around £30 to £50 ($36 to $60) per person, including food, drinks, and entertainment.

Financial planning and savings are crucial for a secure and comfortable lifestyle in the United Kingdom. It is important to set realistic financial goals, budget effectively, and save for the future.

Creating a budget and tracking your expenses is an effective way to manage your finances. It allows you to allocate funds for essential expenses, savings, and discretionary spending. Many online tools and mobile apps are available to help you track your expenses and stay on top of your budget.

Building an emergency fund is an essential part of financial planning. It provides a safety net for unexpected expenses or income disruptions. Experts recommend saving at least three to six months' worth of living expenses as an emergency fund.

In addition to an emergency fund, saving for the future is crucial for long-term financial stability. This can include saving for retirement, education expenses, or major life events such as buying a house or starting a family. Consider consulting a financial advisor to help you create a personalised savings plan based on your goals and aspirations.

Remember, living costs can vary depending on location, lifestyle choices, and personal preferences. It is important to conduct thorough research, consider your priorities, and tailor your budget to suit your individual circumstances. With careful financial planning and smart budgeting, you can navigate the cost of living in the United Kingdom and enjoy all that this vibrant country has to offer.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.