Are you tired of paying hefty fees and getting unfavourable exchange rates when spending money abroad?

Look no further than Currensea, the innovative travel debit card that aims to revolutionise how you manage your finances while travelling.

In this comprehensive review, we will delve deep into the features, benefits, pricing plans, and safety measures offered by Currensea, helping you make an informed decision about whether it's the right choice for your travel needs.

Read on to find out our currensea review as well as how to get started with Currensea.

★★★★★ 4.2

Currensea was founded by Craig Goulding, a former CTO at JPMorgan, and James Lynn, a banking entrepreneur. Their mission was to eliminate the extra charges associated with spending money abroad. By creating the UK's first travel money card that links directly to your bank account, Currensea offers a seamless and cost-effective solution for travelers.

Unlike traditional travel cards, Currensea acts as a "layer" in front of your existing high street bank account. This means that you can use your Currensea card overseas, benefiting from competitive exchange rates and avoiding any overseas transaction fees imposed by your bank.

Say goodbye to the hassle of topping up or prepaying for a travel card, as Currensea conveniently debits your bank account for the amount you've spent.

Currensea's debit card works by connecting to your current bank account, eliminating the need to create a new bank account or manage a prepaid card. The registration process is quick and straightforward, taking only a few minutes to complete.

Once you've signed up, you can connect Currensea with your main bank account and activate your Currensea debit card upon receiving it.

Using your Currensea card is simple. Whenever you make a purchase, you don't have to worry about overseas transaction fees that your bank may typically charge.

Additionally, you can benefit from competitive exchange rates, ensuring that you get the most value for your money while travelling.

Safety is a paramount concern when it comes to managing your finances, especially when travelling. Rest assured, Currensea prioritises security and is regulated by the Financial Conduct Authority (FCA). Currensea is also registered to use Open Banking technology, ensuring that your online banking credentials remain secure.

All transactions made using Currensea are covered by Mastercard's chargeback protection, providing an additional layer of security and peace of mind.

If there's a problem with a purchase you made using your Mastercard, you can ask your bank to dispute the charge. Essentially, you're saying, "Hey, there's a problem with this transaction, and I want my money back."

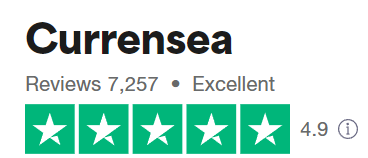

Currensea has a score of 4.9 on Trustpilot, Trustpilot allows verified users of Currensea to provide feedback on the safety and security of the app.

Currensea is a legit company, it has a trustpilot rating of 4.9/5 stars. It is considered to have a straightforward application which is secure and the company is regulated by the FCA.

Currensea offers a range of features designed to enhance your travel experience and save you money. Let's take a closer look at some of the key features:

Getting started with Currensea is a breeze. The application process is quick and efficient, and once approved, your Currensea card will be delivered to your doorstep.

The Currensea app allows you to stay in control of your finances on the go. Monitor your overseas transactions, receive instant notifications, and track how much you've saved with each transaction.

The app provides a seamless user experience, making it easy to manage your money while travelling.

One of the standout features of Currensea is the absence of fees on non-sterling transactions. Whether you're dining at a local restaurant or shopping in a foreign currency, Currensea ensures that you won't incur any additional charges.

With Currensea, you won't have to pay any fees for withdrawing money from ATMs abroad. Enjoy the convenience of accessing cash wherever you are without worrying about unnecessary charges.

Currensea prides itself on transparency and simplicity. There are no hidden fees, such as weekend surcharges or dormant card fees, ensuring that you have complete control over your finances.

Currensea goes above and beyond by giving you the opportunity to contribute to the environment. For every transaction fee you save, Currensea will plant a tree on your behalf, helping to combat deforestation and promote sustainability.

Currensea offers three different price plans, each tailored to suit different travel needs. Let's explore the features and pricing of each plan:

The Essential Plan is perfect for travellers looking to save money on overseas spending. With no overseas transaction fees and competitive exchange rates, you can enjoy your travels without worrying about unnecessary charges.

The Premium Plan is ideal for frequent travellers who want to maximise their savings on overseas spending. With no overseas transaction fees and no FX rate mark-up, you can enjoy a truly fee-free experience while benefiting from additional perks.

The Elite Plan is designed for discerning travellers who want the ultimate experience. Enjoy all the benefits of the Premium Plan, along with exclusive access to a range of luxury perks and services.

★★★★★ 4.2

As with any financial product, it's important to consider the pros and cons before making a decision. Let's explore the advantages and disadvantages of using Currensea:

Currensea offers a compelling solution for travellers looking to save money and simplify their finances while abroad. With its seamless integration with your existing bank account, competitive exchange rates, and fee-free spending, Currensea provides a hassle-free experience that can significantly reduce your costs.

Whether you're a frequent traveller or planning a one-time trip, Currensea is definitely worth considering.

To get started with Currensea, visit their website and sign up for a free account. If you're still unsure, you can also compare other travel cards on the market to find the best fit for your needs. Remember, when making financial decisions, it's always wise to consider your own circumstances and seek independent financial advice if necessary.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.