From the moment you set your heart on a property until the day you hold the keys, there are many steps involved. One of the most crucial steps is the mortgage application process.

A common question that arises during this stage is, "How long does a mortgage application take?"

This insight provides a look into that question, taking you through the various stages of the mortgage application process, expected timelines, and helpful tips to speed things up.

On average, a mortgage application process can take anywhere between 2 to 6 weeks. Factors such as the lender's backlog, borrower's financial complexity, property valuation, and paperwork can influence the approval time. Engaging a mortgage adviser can help expedite the process.

The mortgage application process can be simplified and expedited if you engage the services of a mortgage adviser. An adviser can liaise with the lender, keep track of the application's progress, and promptly handle any additional documentation required. Their expertise can significantly reduce unnecessary waiting times and help move your mortgage application forward more efficiently.

The duration of the mortgage approval process can depend on various factors such as:

If the lender has a backlog of pending applications, it may take longer for your application to be processed.

If your financial situation is complicated (e.g., you're self-employed or have multiple income sources), it can take longer for the lender to assess your application.

The lender needs to assess the property's value before approving the mortgage. If the property valuation takes time, this can delay the process.

If you haven't provided all the necessary documents or if some of the information is incorrect, the lender may need more time to process your application.

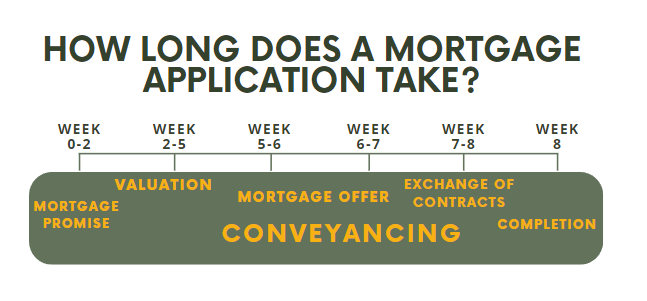

Understanding the mortgage application timeline can give first-time buyers and home movers a clear idea of what lies ahead. So, let's break down the process into six stages.

The first step towards acquiring a mortgage involves obtaining a mortgage in principle. This pre-approval from your lender outlines the amount they are willing to lend for your property purchase. This process is quite simple and can be completed within 24 hours, provided you have all the necessary documents ready.

To apply for a mortgage in principle, lenders typically require:

Once you have a mortgage in principle and have made an offer on a property that has been accepted, you can progress to a full mortgage application. This application usually takes 24 hours to submit, provided you have all the necessary documents ready.

During the full mortgage application process, lenders typically require:

If you're selling a property, to find more on how it can impact your timeline, read our insight: How long after offer accepted to survey?

When you apply for a mortgage, the lender usually conducts a 'Standard Valuation'. This inspection, carried out by an independent surveyor, assesses the property's condition, identifies any significant issues, and compares the property's value with similar properties in the area. The valuation survey usually takes 7-14 days to complete.

For more information on how the varying levels of survey can impact your timeline, read our insight: How long after valuation to mortgage offer?

Once the mortgage valuation survey is complete and the lender's underwriter is satisfied with the results, the lender can make a full mortgage offer. This process typically takes an average of 17 days.

While your mortgage application is being processed, your solicitor will be conducting the necessary conveyancing. This includes applying for local authority searches, which can take about 4 weeks. Once your solicitor has your mortgage offer and local authority search results, they can arrange for contract exchange, which takes around 8 weeks.

The final stage of the mortgage application process is completion. This is when the solicitor arranges for the lender to release the funds, allowing you to complete the property purchase. The time between contract exchange and completion can vary, but the average time is 4 weeks.

Delays in the mortgage application process can be due to various factors, such as a backlog of applications with the lender, complexities in the borrower's financial situation, or incomplete paperwork. If you're concerned about the length of time your application is taking, contact your lender or mortgage broker for an update.

There are no delays in the market for mortgage applications, the standard mortgage timeline is still applicable at between 6-8 weeks. It is possible for this to be less, it depends on the complexity of transaction you require. For example, a remortgage can take as little as 2 weeks.

Once your mortgage application is approved, you will receive a formal mortgage offer from your lender. This official document serves as confirmation that your application has been approved. Typically, the offer is sent to you by mail, but if you're working with a mortgage broker, they may inform you in advance that it's on its way.

The mortgage application process can be expedited by submitting a well-prepared and complete application. An experienced mortgage broker can guide you through this process, ensuring that all required documents are submitted correctly and promptly.

The question of "how long does a mortgage application take" doesn't have a one-size-fits-all answer. Several factors can influence the timeline, including the lender's backlog, the complexity of the borrower's financial situation, and the property's value.

However, by understanding the process and preparing well in advance, you can navigate the mortgage application process more efficiently and confidently. Remember, every step brings you closer to owning your dream home!

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Cheltenham, Gloucestershire

Cheltenham, Gloucestershire No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.