Purchasing a property is a significant financial commitment, often requiring substantial resources. However, for many, particularly the younger generation and first-time buyers, this milestone can be challenging to achieve independently.

This is where a joint borrower sole proprietor mortgage (JBSP) comes in.

This financial product offers an innovative solution, allowing individuals to secure a property with the help of co-borrowers, while still retaining sole ownership.

In this insight, we'll delve into the intricacies of a JBSP mortgage, discussing its functionalities, benefits, potential drawbacks, and more.

A joint borrower sole proprietor mortgage is a lending arrangement where multiple individuals share the financial responsibility of a mortgage, but only one person holds the legal ownership of the property. This arrangement is particularly beneficial for those who may struggle to meet the income requirements of a mortgage on their own.

Typically, up to four individuals can participate in a Joint Borrower Sole Proprietor Mortgage, but it's crucial to note that all applicants are legally responsible for ensuring the mortgage is paid, regardless of the ownership status.

The fundamental aspects of a JBSP mortgage set it apart from other mortgage types. Here are some of the key features:

In JBSP mortgages, despite multiple borrowers, only one person, the 'sole proprietor,' holds legal ownership of the property. It's a way to have your cake and eat it too—sharing homeownership without dividing the title.

JBSP mortgages create a strong financial partnership. All borrowers are jointly responsible for mortgage repayments. If one borrower faces financial challenges and can't make their payment, the others step in to cover the shortfall.

Traditionally, JBSP mortgages typically designate the sole proprietor as the property's resident, leaving other co-borrowers to find their own place. However, some lenders now offer flexibility in residency rules, providing options to suit various situations.

JBSP mortgages are designed to adapt to life's unpredictabilities. Co-borrowers can adjust their financial contributions over time, making it possible to reduce payments as the primary borrower's income grows.

A Joint Borrower Sole Proprietor Mortgage is particularly appealing to first-time buyers who may not have the financial capacity to secure a mortgage independently. By combining incomes, a larger pool of funds is available, opening up a wider range of property options.

Additionally, this arrangement can be beneficial for self-employed individuals or those with fluctuating incomes who may struggle to meet traditional lending criteria.

While the precise eligibility criteria may vary between lenders, typical considerations include:

An applicant's income is a crucial factor. Lenders will assess the collective income of all borrowers to determine the loan amount.

A good credit score is essential for all borrowers involved in the application.

Age is also taken into account. Most lenders have an upper age limit for the oldest borrower at the end of the mortgage term.

The financial commitments of the joint borrowers will also be assessed. If co-borrowers have substantial existing debts, some lenders may be hesitant to approve the mortgage.

The borrowing capacity under a JBSP mortgage is generally calculated by combining the incomes of all borrowers and multiplying the total by a specific factor, often 4.5. This calculation allows borrowers to secure a larger loan than they would be able to do independently.

Once you are ready to proceed you can find out exactly how much you can borrow by applying for a mortgage promise.

The age limit for a JBSP mortgage varies among lenders. While most mortgage lenders typically have an age limit of 70, some lenders may extend it to 80 or even 85. It's important to note that these age limits apply regardless of the non-homeowner's status on the mortgage.

Understanding how a JBSP mortgage differs from other mortgage types can help you determine whether it's the right option for you.

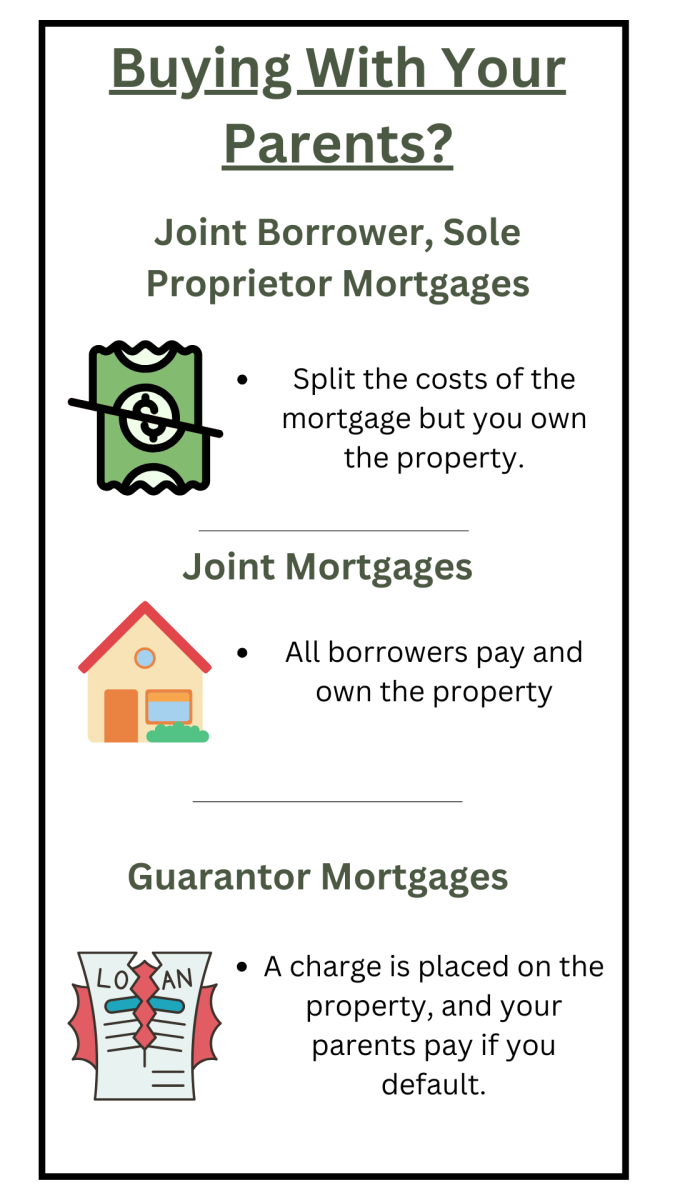

In a joint mortgage, multiple applicants buy a property together, share the responsibility of the mortgage repayments, and hold legal ownership of the property. In contrast, a JBSP mortgage allows multiple applicants to share the mortgage liability, but only one individual holds ownership, providing full control and decision-making power to one person.

In a guarantor mortgage, a third party (usually a close relative) agrees to cover the mortgage payments if the primary borrower defaults. Unlike a JBSP mortgage, guarantors are typically only required to step in if a debt arises, while in a JBSP arrangement, they contribute to the payments from the beginning.

JBSP mortgages can increase affordability by combining the incomes of multiple borrowers, making it easier for them to qualify for a larger mortgage or better terms. This is particularly beneficial for first-time buyers who may not meet the income requirements on their own.

For A young couple wants to buy their first home but individually, their incomes do not meet the lender's criteria for the desired mortgage amount. By using a JBSP mortgage with both of their incomes considered, they can afford the home they want.

Lenders may view JBSP mortgages as lower risk because multiple responsible parties are involved. This reduced perceived risk can result in more favourable mortgage terms, such as lower interest rates or a smaller down payment requirement.

For example a lender may offer a lower interest rate to a married couple applying for a JBSP mortgage because the combined financial stability of both spouses reduces the risk of default.

Despite the financial contributions of the joint borrowers, sole ownership of the property remains with one individual. This can be advantageous for someone who wants complete control over the property's use, improvements, or future decisions.

For example, an individual wants to purchase a property for investment purposes. They invite a friend to be a joint borrower to secure a more favourable mortgage rate but wish to retain sole ownership and decision-making authority regarding the property.

In some regions or countries, non-proprietor borrowers in JBSP mortgages are exempt from additional stamp duty charges for second properties. This exemption can result in cost savings for the individuals assisting with the purchase.

In a JBSP mortgage, all borrowers are equally responsible for repaying the loan. If one party, for example, loses their job or faces financial difficulties and cannot contribute to the mortgage payments, the burden falls on the other borrower(s). This shared liability can strain relationships and financial stability.

For Example: Two siblings decide to purchase a property together using a JBSP mortgage. If one sibling loses their job and can't contribute to the mortgage, the other sibling must cover the full mortgage payment, potentially causing financial stress and tension between them.

Any financial arrangement involving multiple parties carries the risk of disagreements or conflicts. In the context of JBSP mortgages, disputes may arise regarding financial contributions, property use, or future plans for the property. These disputes can strain personal relationships.

For example a couple decides to use a JBSP mortgage to buy a home. Over time, they have different ideas about how to use the property and can't agree on whether to sell or rent it. This leads to ongoing arguments and negatively affects their relationship.

While co-borrowers in a JBSP mortgage contribute financially, they do not have legal ownership rights to the property. This lack of ownership can be a drawback for individuals who want more control or decision-making power over the property.

For example, a parent and adult child decide on a JBSP mortgage to purchase a home for the child to live in during university. The parent contributes to the mortgage but cannot make decisions about property improvements or future sales without the child's agreement.

Yes, you can get a mortgage with your son through a joint borrower sole proprietor mortgage. This arrangement allows you to use his income and credit to help qualify for the mortgage while you maintain sole ownership of the property.

Yes, you can get a mortgage with your parents through a joint borrower sole proprietor mortgage. However, the mortgage term will be able to run until the oldest borrower's retirement age using employment income. After that, retirement income must be considered. Max age is usually 75. Many lenders only allow sponsors to apply when they are younger than 60.

While the number of lenders offering JBSP mortgages is relatively limited, well-prepared applications can secure favourable deals with suitable lenders. It's advisable to seek professional advice when considering a JBSP mortgage.

Remember, a joint borrower sole proprietor mortgage represents an innovative solution for those struggling to secure a property independently. By understanding its workings, benefits, and potential drawbacks, you can make an informed decision about whether a JBSP mortgage is the right path for you.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.