If you're considering taking on new clients as a Mortgage Adviser, you might have experimented with various marketing tools available to you. Now, you might be wondering about one of the methods of marketing that has been publicly shamed: buying mortgage leads. However, this negative perception shouldn't be the case. Consider this: What's more valuable – being occupied with assisting clients or being engrossed in managing Google ads? As an adviser, I know which option I would prefer. When you delve into it, having your own pay-per-click campaign is fine, but what does a mere click accomplish? Your purpose isn't to sell clicks; it's to help people. This is precisely where Sunny Avenue comes into play. We're approaching lead generation differently, so continue reading to discover how Sunny Avenue can support you with Mortgage Leads.

And before we start, we are not a sleazy marketing agency that sells you credits that can't be spent. We're putting our money where our mouth is and passing you genuine requests for advice.

A mortgage lead is information about a potential customer interested in obtaining a mortgage loan. It typically includes their contact details and specific details about their mortgage needs, serving as a basis for mortgage advisers and lenders to initiate communication and offer their services.

Sunny Avenue doesn't view our visitors as "leads" - to us, they are just people, seeking advice. For that reason, our priority is to ensure they are provided with the best advice available to them.

A warm mortgage lead refers to a potential customer who has shown a higher level of interest and engagement in obtaining a mortgage loan. This could be someone who has expressed interest, provided their contact details, or demonstrated an intent to proceed with a mortgage application. Warm leads are more likely to convert into actual clients compared to cold leads with minimal engagement.

All the introductions facilitated by Sunny Avenue fall into the category of warm mortgage leads, owing to the fact that the client has requested advice through our Fact Find form.

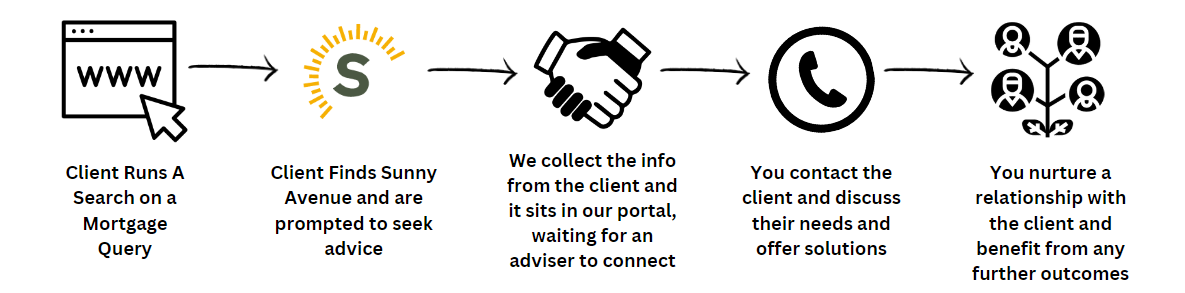

Here is how we operate:

Numerous methods exist for generating mortgage leads. Over reliance on a single method might carry risks. For instance, if your primary lead supplier shuts down or Google ads surge in price.

Some of the most commonly employed sources of mortgage leads include:

Online Marketing: Explore the realm of digital platforms, including refining search engine optimisation (SEO), executing pay-per-click (PPC) advertising, launching social media campaigns, and employing email marketing. These avenues aim to captivate potential clients actively seeking mortgage solutions.

Content Creation: Underline the significance of crafting informative blog posts, videos, and guides centred around mortgage subjects. Showcase your expertise, engage your audience, and capture leads through downloadable content and subscriptions.

Networking: Stress the importance of cultivating professional relationships within the real estate and financial domains. Attend industry events, become part of pertinent associations, and utilise networking platforms to connect with potential clients and referral sources.

Partnerships: Expound upon the benefits of forging collaborations with real estate agents, builders, and other professionals within related industries. Establish mutually beneficial relationships that facilitate reciprocal referrals, broadening your outreach and lead pool.

Remember, lead generation isn't a one-size-fits-all approach; it's about finding the methods that resonate best with your clients.

Sunny Avenue utilises Search engine optimisation to bring users to our website, it's the most cost-effective way to introduce people as it involves little spend our side. Another way we can keep costs down.

Mortgage leads can vary in cost, most lead generation companies use a methodology based on the likelihood to convert to a sale. That model often leads to disappointment for both parties, the adviser and the client. That's often because the conversation is quickly over when despite the client saying they need a £500k mortgage, they haven't actually got a visa, or any income. The worst thing is these leads are priced at £50+.

At Sunny Avenue, we put a price cap on leads, the most we charge for an introduction will be £25. However, we also provide £0 leads. Ultimately, we are more concerned with finding the most suitable advice for the client, than overcharging on leads.

Many lead generation companies purchase client data from bizarre sources, like Tesco's. They use this data to attempt to determine if the client may be a homeowner and such. This data is then sold to you at an extortionate price and the client has no idea. These are cold leads, they result in no relationships. Most of the time, the client doesn't even answer the phone.

At Sunny Avenue, the mortgage leads we generate come through Sunny Avenue. They are genuine requests for advice, made by the clients themselves. These clients have found our website and decided to pursue their advice needs further.

Many lead generation companies resell that same data to many different advisers.

At Sunny Avenue, once we pass you the client details, we expect you to manage a life-long relationship with the client. We do not pass those details on to anyone else.

To get started with Sunny Avenue Mortgage leads, you need a profile. Our profiles are free, and your details are published in our adviser directory. This offers our visitors a way to select their own adviser. The clients can message you through our Sunny Mail system, or book straight into your diary through our Calendly integration.

At present, the only fees that exist on Sunny Avenue are associated with client introductions. Any fees are clearly stated alongside the introduction. These fees help us to keep running. We do not have fees to become a member or display a profile.

Buying leads can be an effective part of your marketing strategy. When you buy a lead, you should treat the client as you would with any other, servicing all of their needs fully. It's easy to get caught up in a quick sale but that is when you can find you have a low conversion rate.

To sum up, there's no need to feel ashamed about buying mortgage leads – it's a legitimate part of your marketing, just like getting clicks. Sunny Avenue works simply: we bring visitors to our site who are looking for mortgage help, and we connect them with you. Our way of making money lets us offer quality leads at better prices than others, boosting your ROI.

We urge you to take the ideas in this insight and put them to work – use smart strategies that fit your strengths and clients.

Sunny Avenue stands out by caring about real client needs and building strong relationships. Join us for a successful journey with mortgage leads that's all about honesty and success.

Any Questions? Contact Us At: hello@sunnyavenue.co.uk

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.