Borrowers worldwide are primed to feel the pinch as fiscal bodies like the Bank of England raise interest rates to counteract escalating inflation. On 22nd June 2023, the UK's bank of England boosted rates to an unprecedented 5%, making borrowing as expensive as 2008. Consequently, if you're a mortgage holder, overpaying your mortgage may be a sound financial strategy.

In the wake of these circumstances, this insight provides an in-depth exploration of the pros and cons of overpaying your mortgage, offering valuable insights to help you make an informed decision.

Before delving into the specifics, it's crucial to understand what overpaying your mortgage entails. Essentially, it involves paying more than your scheduled monthly repayments, thus reducing your mortgage debt faster than originally planned. By making additional payments, you can potentially save on interest costs and shorten the overall repayment term, ultimately helping you become mortgage-free sooner. Overpaying can be a strategic financial move to build equity in your property and achieve long-term financial freedom.

Interest rates significantly influence the cost of borrowing. As rates increase, so do the expenses attached to loans and mortgages. This shift can have a profound effect on your financial stability and overall quality of life.

Higher interest rates mean higher costs for borrowers. If your mortgage is on a tracker or variable rate, you're likely already feeling the effects of the Bank of England's decision.

As interest rates rise, so does the overall cost of your mortgage. This change could mean you end up paying significantly more for your home than you initially bargained for.

Though the prospect of parting with more of your hard-earned money each month may seem daunting, overpaying your mortgage has several significant benefits.

By overpaying your mortgage, you can reduce your debt faster, effectively shaving years off your mortgage term. For instance, if you have a £150,000 mortgage that you're repaying over 20 years, overpaying by £100 a month could mean you repay the full amount 2 years and 10 months earlier.

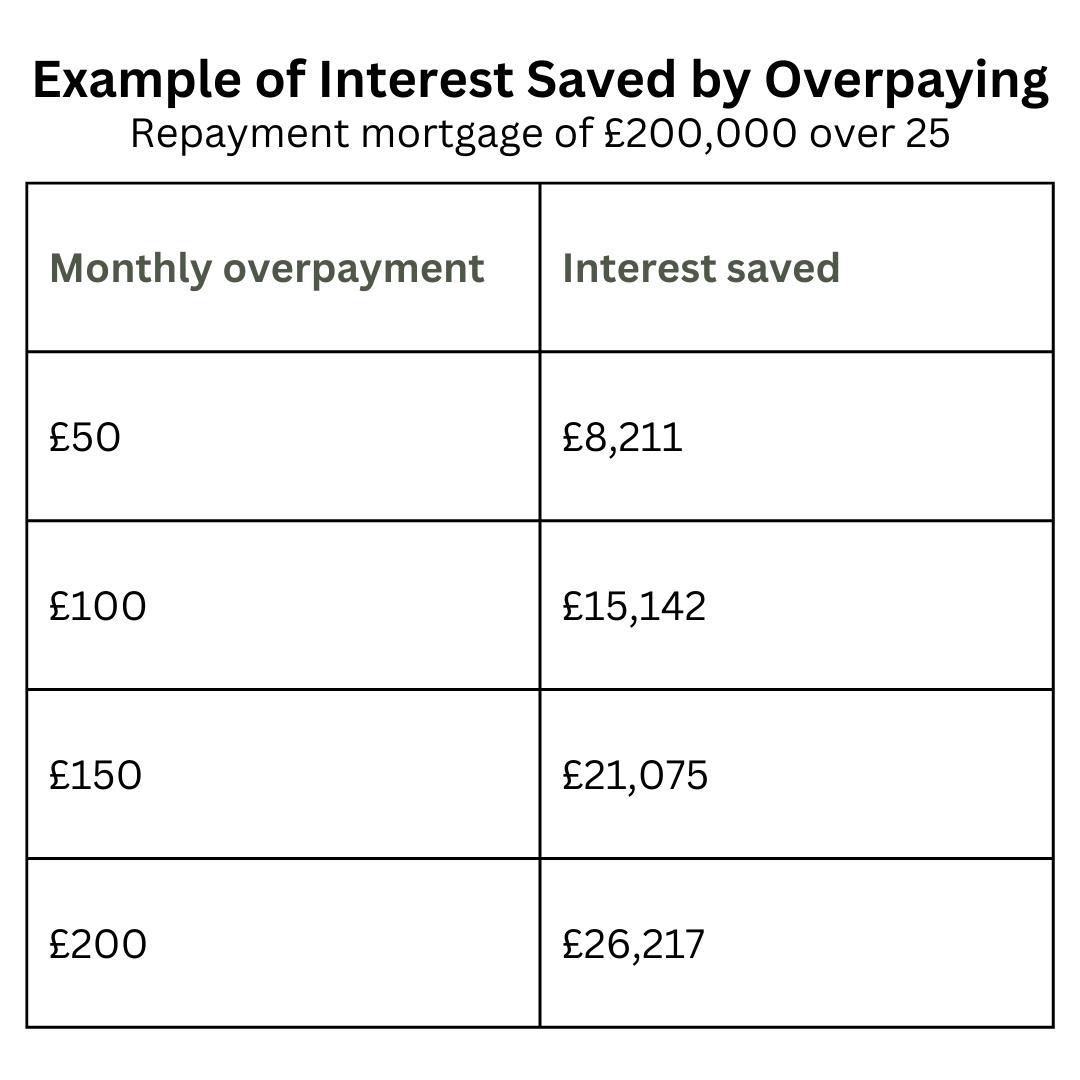

Because the amount of interest you pay is based on your outstanding debt, overpayments can mean you pay less interest in the long run. So, while your expenses may increase in the short term, you could be financially better off overall.

Overpaying can also boost your chances of securing a better mortgage deal in the future. By making overpayments and increasing your equity, you could lower your loan-to-value (LTV) ratio, which measures your mortgage debt against your home's value. A lower LTV often results in a better interest rate, reducing your repayments and overall borrowing cost.

While overpaying your mortgage has its benefits, it's essential to consider the potential drawbacks.

Overpaying your mortgage means parting with more of your cash each month. Once you've made an overpayment, it's challenging to get that money back, reducing your financial flexibility.

Some mortgage providers charge fees for overpayments. Usually, you can overpay up to 10% of the mortgage debt before facing any additional charges. However, unexpected fees could mean your overpayments don't stretch as far, or it doesn't make financial sense.

Before you decide to overpay your mortgage, it's worth considering some alternatives.

Shop around for better savings rates: While current accounts offer meagre interest rates, some savings accounts could deliver reasonable returns.

Pay off more expensive debt: Your mortgage may be your most considerable debt, but it might not be the most costly. Clearing credit card debts, unsecured loans, and overdrafts could be a more financially savvy move.

Top up your pension pot: Putting spare cash into your pension pot can be a smart move. Not only do you get tax relief, but the funds are also invested to help them grow.

Remortgage for a lower rate: Remortgaging to a better mortgage deal could save you money, especially given the widespread low rates.

If overpaying is not an option, as it won't be possible for every borrower, and you're in need of finding ways to relieve the pressure the rising interest rates have put upon you. Consider an alternative of extending your mortgage term:

Overpaying your mortgage can be a smart move, especially in the face of rising interest rates. However, it's vital to weigh up the pros and cons before making a decision. If you're unsure, consider speaking to a mortgage adviser or an independent mortgage adviser. They can provide a clear snapshot of your options and help you find the best deals.

So, as you navigate the stormy seas of rising interest rates, remember that overpaying your mortgage might just be the lifeboat you need to keep your financial ship afloat.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.